Fueled by a weak yen and appealing prices, foreign buyers are increasingly interested in Japan's real estate market, attracted to its high-quality investments, robust infrastructure, and desirable urban and rural locales. As Japan enters its green season, major cities and resort areas are experiencing increased inquiries and demand for properties. Discover the primary motivations behind foreign property acquisitions and gain valuable advice for making informed real estate investments in Japan.

Value and affordability

Japan’s rich cultural heritage and unique lifestyle continue to attract foreigners but thanks to the weakened yen, Japan foreign investors are incentivised to stretch their finances even in the Japanese real estate market. Combined with Japan’s low inflation rates and stable property values, the market offers an incredible opportunity for long-term capital appreciation. For this reason, many foreigners who have worked are seizing this opportunity to purchase properties before prices increase.

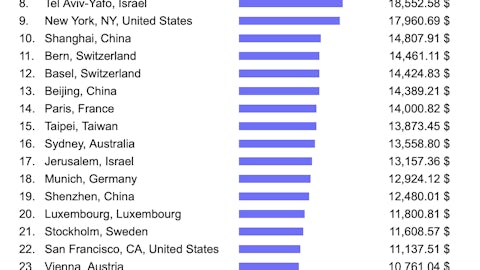

Tokyo, widely considered to have the higher cost per square meter (USD) of properties in Japan, compared favourably to different cities around the world as shown in the table below from Numbeo.

Strong rental market and stable investment

Japan, the world's third-largest economy, offers a secure investment climate supported by its government's efforts to attract foreign capital. Consequently, Japanese resorts like Niseko and Hakuba boast strong rental returns throughout the year. These areas provide continuous income potential for investors in Japanese resort real estate, attracting visitors with winter ski activities and summer offerings like hiking, cycling, and festivals.

Convenience

Japan's real estate market offers a relatively easy path for foreign buyers. With no special taxes, restrictions, or residency requirements, purchasing residential or commercial property is a transparent and appealing process for international investors. This lack of complexity contrasts with other countries, making Japan an attractive option.

Buy now, rent by summer: Tips for New Investors

Discover some essential tips on how to invest smartly if you're entering the Japanese real estate market today:

- Define your goals: Determine your strategies for investing in the Japanese real estate market. Research your market type and home values, and understand the current trends and unique features of your chosen neighbourhood (e.g., amenities, school districts, tourist spots). Each property type has its desirable features, risks, and costs.

- Be flexible: With high demand, desirable properties move fast. Keep an open mind and consider alternatives when purchasing properties that match your investment style, preferences, and portfolio.

- Be ready to act: Once you have determined your goals and researched your desired property, be ready to act quickly on your finances and prepare your property for renting. Ensure to account for total costs—including acquisition fees, property management, maintenance, and potential rental income in all costs, to secure financial stability and expected returns.

Planning, flexibility, patience, and a clear goal are essential for investors entering the spring real estate market. Whether you're buying or renting, keep a close eye on the market and be prepared to seize opportunities as they arise.